All Forex Strategies

The Newest Forex Strategies updated Every Week

Tuesday, July 27, 2010

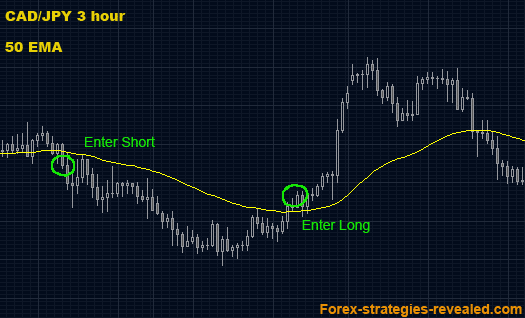

Forex trading strategy #8 (EMA breakthrough)

Quite often very interesting combination can be spotted. Here is one Simple Forex system based on 50 EMA indicator.

Any currency pair.

Time frame: 90 minute or 3 hour chart

Indicator: 50 EMA.

Entry: watch for a candle to pierce 50 EMA and finally close above (to enter Long) or below (to go Short). Enter with the second candle after it makes 5 pips higher than the previous one.

Exit: not set.

Stop loss order: 15 pips below 50 EMA.

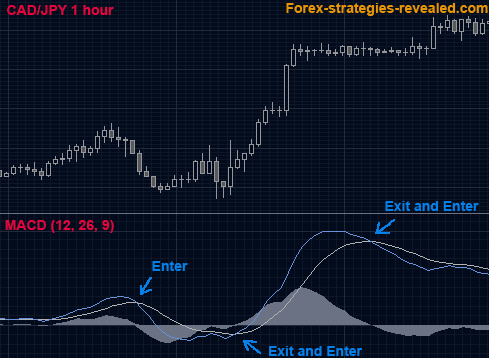

Forex trading strategy #7 (Simple MACD crossover)

Let's take a glance at the very basis of currencies trading with MACD indicator.

We will need only MACD indicator with standard settings: 12, 26, 9.

Any time frame as well as any currency pair can be used.

Entry rules: When the MACD lines’ crossover appears – enter (or wait for the price bar to close and then enter).

Exit rules: when MACD lines next crossover occurs.

Advantages: very simple approach and can give good profitable entries. Traders may want to change MACD default settings depending on the currency and chosen time frame. For example, traders may test next MACD set ups: USD/CHF MACD (04, 07, 16), EUR/USD MACD (02, 03, 20), GBP/USD MACD (02, 03, 04) for different time frames.

Disadvantages: you will need to sit and monitor it again and again. MACD has little use in sideways trading market. It is also never used alone, but rather in combination with other indicators.

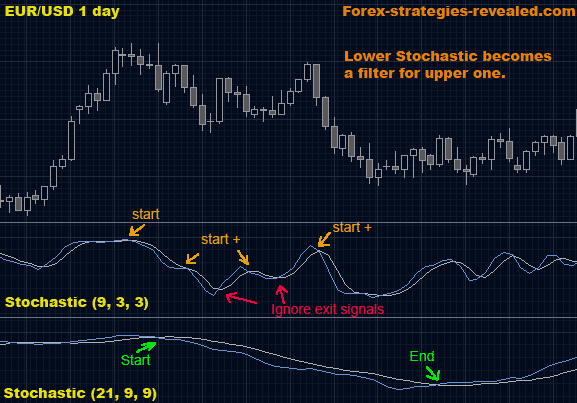

Forex trading strategy #6 (Double Stochastic)

Strategy Requirements:

Currency pairs: ANY

Time frame chart: 1 hour, 1 day

Indicators: Full Stochastic (21, 9, 9) and Full Stochastic (9, 3, 3).

Entry rules: When the Stochastic (21, 9, 9) lines’ crossover appears – enter (or wait for the current price bar to close and then enter). It will be the major trend.

Look at Stochastic (9, 3, 3) to anticipate swings inside the main trend and re-enter+ the market again – additional entries. Also ignore the short-term moves Stochastic (9, 3, 3) that signal for exit – do not exit early until Stochastic (21, 9, 9) gives a clear signal to do so.

Exit rules: at the next cross of major Stochastic (21, 9, 9) lines.

Advantages: using two Stochastic indicators helps to see the major trend and the swings inside it. This gives more accurate entry ruless and gives a good exit rules.

Disadvantages: needs constant monitoring, and again we are dealing with a lagging indicator.

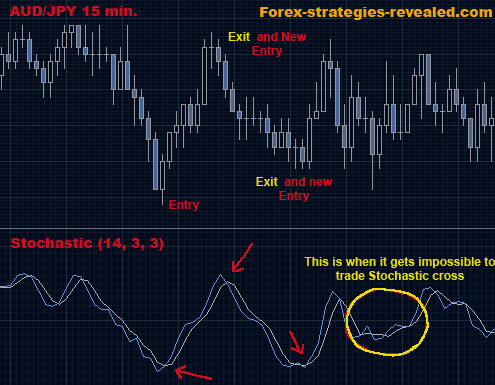

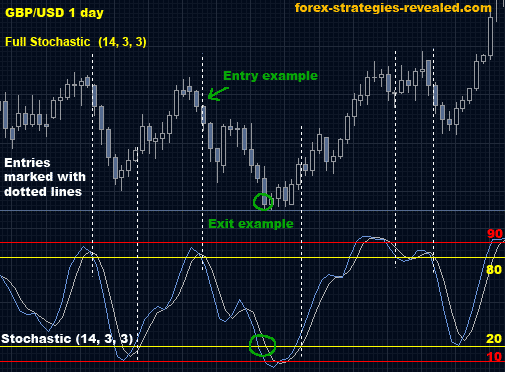

Forex trading strategy #5 (Stochastic lines crossover)

Currency pair: Any.

Time frame: Any.

Indicator: Stochastic (14, 3, 3)

Entry rules: Buy when the faster moving Stochastic line crosses above and up over slower moving stochastic line.

Exit rules: Sell when the opposite situation (next crossover) occurs and right after that open an opposite position. It is again recommended, once the first touch of Stochastic lines (possible future crossover) has been spotted, to wait until the following price bar on the chart has closed and only then take actions.

Advantages: can give entry and exit rules, easy to use. Disadvantages: Stochastic is a lagging indicator – with this lines crossover system it can create a lot of false signals. Traders may want to change Stochastic regular settings for each particular currency pair to eliminate as many false signals as possible. Stochastic crossover system is good when used in combination with other indicators.

Monday, July 19, 2010

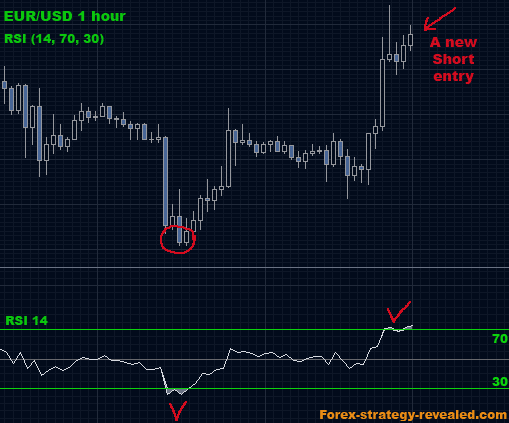

Forex trading strategy #4 (RSI High-Low)

Although no trading system can solely rely on RSI indicator, using it in combination with other tools and proper technical analysis can bring a new edge to your Forex trading.

Setup:Currency pair: Any.

Time frame: Any.

Indicator: RSI (14) with levels at 70 and 30.

Entry rules: Buy when RSI has crossed below 30, formed a bottom, and then crossed back up through 30.Entry rules: Sell when RSI has crossed above 70, formed a peak, and then crossed back down through 70.

Exit rules: not set.

Advantages: RSI is a very good indicator to refer for confirmation for any entry in any simple or complex trading system. For current trading method it advices well on entries, but opportunities occur not that often.Disadvantages: monitoring is needed, still false signals take place. Strategy is suggested to be used in combination with other ones.

Forex trading strategy #3 (Stochastic High-Low)

Currency pair: Any.

Time frame: Any.

Indicator: Full Stochastic (14, 3, 3) Entry rules: When Stochastic has crossed below 20, reached 10, and then crossed back up through 20 – set BUY order.

Entry rules: Sell when Stochastic has crossed above 80, reached 90, and then crossed back down through 80.

Exit rules: close trade when Stochastic lines rich the opposite side (80 for Buy order, 20 for Sell order).

Advantages: gives quite accurate entry/exit signals in well trending market.

Disadvantages: needs periodical monitoring. Stochastic is suggested to be used along with other indicators to eliminated entering on false signals.

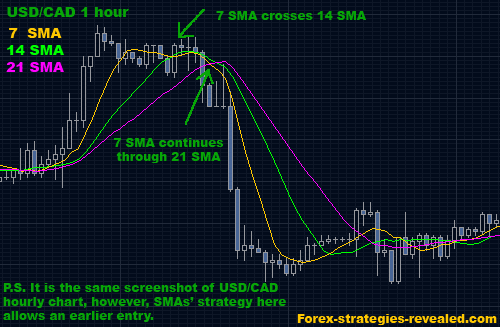

Forex trading strategy #2 (Slow moving averages crossover)

Current strategy applies the same principles as Strategy #1.

Use time frame and currency which respond the best (1 hour, 1 day… or any other).

Indicators: (multiple of 7) 7 SMA, 14 SMA, 21 SMA.

Entry rules: When 7 SMA goes through 14 and continues through 21, BUY/SELL in the direction of 7 SMA once price gets through 21 SMA.

Exit rules: exit when 7 SMA goes back and touches 21 SMA.

Advantages: again it is an easy set up and does not require any calculations or other studies. Can produce very good results during strong market moves, the system also can be easily programmed and traded automatically.Disadvantages: System requires periodical monitoring according to a chosen time frame. SMA indicator signal can be confirmed after the current price bar has been fully formed and closed. In other words, when SMA stops changing and the signal is fixed, traders may rely on such information to open a trade.

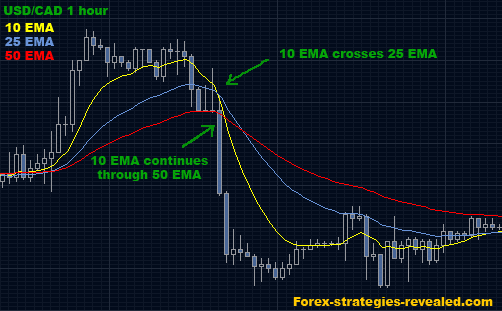

Forex trading strategy #1 (Fast moving averages crossover)

Currency pairs: ANY

Time frame chart: 1 hour or 15 minute chart.

Indicators: 10 EMA, 25 EMA, 50 EMA.

Entry rules: When 10 EMA goes through 25 EMA and continues through 50 EMA, BUY/SELL in the direction of 10 EMA once it clearly makes it through 50 EMA. (Just wait for the current price bar to close on the opposite site of 50 EMA. This waiting helps to avoid false signals).

Exit rules: option1: exit when 10 EMA crosses 25 EMA again.

option2: exit when 10 EMA returns and touches 50 EMA (again it is suggested to wait until the current price bar after so called “touch” has been closed on the opposite side of 50 EMA).

Advantages: it is easy to use, and it gives very good results when the market is trending, during big price break-outs and big price moves.

Disadvantages: Fast moving average indicator is a follow-up indicator or it is also called a lagging indicator, which means it does not predict future market directions, but rather reflects current situation on the market. This characteristic makes it vulnerable: firstly, because it can change its signals any time, secondly – because need to watch it all the time; and finally, when market trades sideways (no trend)with very little fluctuation in price it can give many false signals, so it is not suggested to use it during such periods.