Here is a very basic overview of a role of a Stochastic indicator in the Forex trading. Knowing exactly what to expect from Stochastic, if you ever plan to add it to your own system, will affect trading results dramatically. For this trading method:

Currency pair: Any.

Time frame: Any.

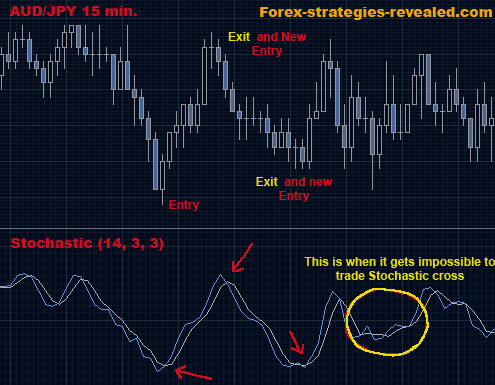

Indicator: Stochastic (14, 3, 3)

Entry rules: Buy when the faster moving Stochastic line crosses above and up over slower moving stochastic line.

Exit rules: Sell when the opposite situation (next crossover) occurs and right after that open an opposite position. It is again recommended, once the first touch of Stochastic lines (possible future crossover) has been spotted, to wait until the following price bar on the chart has closed and only then take actions.

Advantages: can give entry and exit rules, easy to use. Disadvantages: Stochastic is a lagging indicator – with this lines crossover system it can create a lot of false signals. Traders may want to change Stochastic regular settings for each particular currency pair to eliminate as many false signals as possible. Stochastic crossover system is good when used in combination with other indicators.

No comments:

Post a Comment